A 401(K) is essentially a savings account that provides employees with the opportunity to invest what they have earned. There are many different investment options available such as mutual funds, stocks, etc. which makes it a great choice for those who have employers that provide this option.

How a 401K Works

Classified as a “qualified retirement plan,” a 401K is eligible for tax benefits set forth by the Internal Revenue Service. You can either pay the taxes on your investment at the time that you make a deposit into your account with a ROTH 401K or choose to pay taxes on your withdrawals when you retire.

The funds in your account are put to work, meaning that its available balance depends upon how much you invest as well as the performance of the investments within it. The best part about this type of retirement plan is that it’s taken directly from your paycheck to ensure you remain consistent.

Pros of Having a 401K

For those who work with a company that offers them the option to put their money away for retirement via a 401K, you might be wondering if it’s a smart choice to make. The short answer is yes, but that was only brought to light after revealing the benefits below.

· Depending on the type of 401(K), you choose when to pay taxes on it.

A traditional 401K will charge you taxes each time you make a withdrawal, but you don’t have to pay the taxes when you initially make the investment into your 401K. An alternative that has become more popular is a ROTH 401K, which allows you to pay taxes now rather than later.

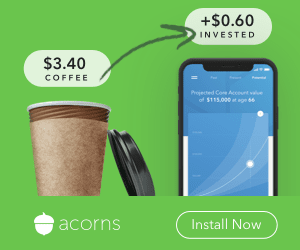

· Over the years, your money will have the chance to grow.

Since a 401(K) offers the chance to have a diverse range of investments, your money will not just sit in a savings account to get a minimal return. Instead, you will be able to see your money grow over the years in order to provide you with a nest egg that’s sure to cover the cost of living when it’s time for you to stop working.

· Some employers will match your contributions to provide an added value.

The most common forms of matching used by employers are either a 100% match ($1.00 for every $1.00 you put in your 401K) and matching 50% of your investment ($0.50 for every $1.00) which essentially gives you free money. Not only does it help make companies stand apart from their competition to attract the best talent, but it also helps encourage employee loyalty.

Keep in mind that a 401(K) has to be offered by your employer before you can take advantage of it. The strongest offering is where your employer will match its investments. Also make sure that you don’t invest everything into the company itself, as the future can be rather unpredictable. Diversify.